Using a Payroll Provider in the Recording Studio

Running a recording studio is no easy task. From managing talented musicians to ensuring top-notch sound quality, there's a lot on your plate. One aspect that often gets overlooked is managing payroll. As your creative team grows, keeping track of hours worked, calculating salaries, and ensuring timely payments can become a major headache.

That's where a payroll provider comes in. A professional payroll service can save you time, money, and stress by handling all your payroll needs. From employee onboarding to calculating taxes and generating pay stubs, they take care of the nitty-gritty details, giving you the freedom to focus on what you do best - producing great music.

The Importance of Payroll Management in a Recording Studio

Payroll management is a crucial aspect of running a recording studio. It ensures that your employees are paid accurately and on time, which is essential for maintaining a happy and motivated workforce. Without proper payroll management, you risk making costly mistakes that can lead to legal issues and damage your reputation.

In the recording studio industry, where projects often involve multiple musicians, engineers, and other professionals, keeping track of hours worked and calculating salaries can be a complex task. Additionally, recording studios may also have to deal with different payment structures, such as hourly rates, session fees, or royalties. This makes it even more important to have a streamlined and efficient payroll system in place.

By using a payroll provider, you can avoid these challenges and ensure that your payroll processes run smoothly. They have the expertise and tools to handle all aspects of payroll management, from calculating salaries and deductions to generating pay stubs and handling tax filings. This not only saves you time and effort but also minimizes the risk of errors and non-compliance with tax regulations.

Benefits of Using a Payroll Provider

Using a payroll provider in the recording studio industry offers numerous benefits. Let's explore some of the key advantages:

- Time and Cost Savings: Managing payroll in-house can be a time-consuming and expensive task. By outsourcing this function to a payroll provider, you can free up valuable time and resources that can be better utilized in growing your business. Payroll providers have automated systems and dedicated teams that can process payroll quickly and accurately, saving you both time and money.

- Accuracy and Compliance: Payroll providers have expert knowledge of tax regulations and employment laws. They stay up-to-date with the latest changes and ensure that your payroll processes comply with all legal requirements. This helps you avoid costly penalties and audits, giving you peace of mind that your payroll is being handled correctly.

- Employee Satisfaction: Timely and accurate payment is crucial for employee satisfaction and morale. By using a payroll provider, you can ensure that your employees are paid on time, every time. This boosts their trust in your organization and creates a positive work environment, leading to higher productivity and lower turnover rates.

- Data Security: Payroll providers have robust security measures in place to protect sensitive employee data. They use encryption, firewalls, and other security protocols to safeguard your payroll information from unauthorized access or data breaches. This gives you added confidence that your payroll data is safe and secure.

- Streamlined Processes: Payroll providers offer user-friendly platforms and tools that make it easy to manage your payroll processes. From employee onboarding to generating pay stubs, everything can be done online, saving you the hassle of manual paperwork and reducing the chances of errors. This streamlines your payroll processes and improves overall efficiency.

Common Payroll Challenges in the Recording Studio Industry

The recording studio industry poses unique challenges when it comes to payroll management. Let's take a look at some of the common challenges faced by recording studio owners:

- Complex Payment Structures: Recording studios often work with musicians and other professionals who have different payment structures. Some may be paid hourly, while others may receive session fees or royalties. Keeping track of these varying payment structures can be challenging and time-consuming.

- Project-Based Payroll: Many recording studio projects are short-term or project-based. This means that employees may work on multiple projects simultaneously or have irregular working hours. Calculating salaries and managing payroll for such employees can be complex, requiring careful tracking of hours worked and accurate calculation of payments.

- Tax Compliance: Recording studios must comply with various tax regulations, including income tax, social security contributions, and other payroll-related taxes. Staying compliant with these regulations can be daunting, especially when there are frequent changes in tax laws. Missing deadlines or making errors in tax filings can result in penalties and legal issues.

- Recordkeeping: Recording studios need to maintain detailed records of employee hours, wages, and tax deductions. These records are not only important for payroll processing but also for tax audits and compliance inspections. Managing and organizing these records can be time-consuming, especially if done manually.

Using a payroll provider can help overcome these challenges and ensure that your payroll processes are efficient, accurate, and compliant with all relevant regulations.

How to Choose the Right Payroll Provider for Your Recording Studio

Choosing the right payroll provider is crucial for the success of your recording studio. Here are some factors to consider when selecting a payroll provider:

- Experience and Expertise: Look for a payroll provider that has experience working with recording studios or similar creative industries. They should have a solid understanding of the unique payroll requirements and challenges faced by recording studios.

- Scalability: Consider your future growth plans and choose a payroll provider that can scale with your business. They should be able to handle an increasing number of employees and adapt to changes in your payroll processes.

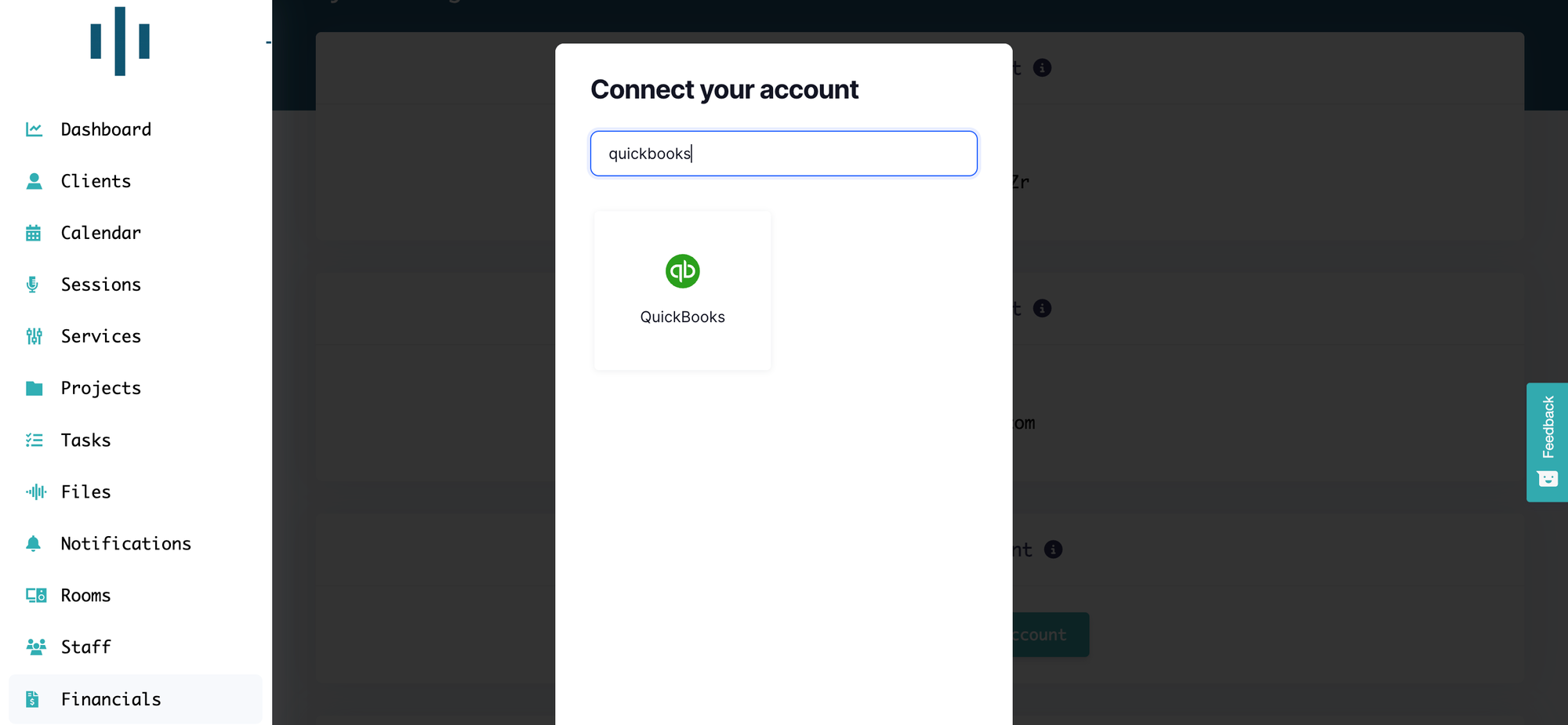

- Technology and Integration: Ensure that the payroll provider's software and platforms are user-friendly and integrate seamlessly with your existing studio management systems. This will make it easier to transfer data and streamline your overall operations.

- Support and Customer Service: Payroll issues can arise at any time, so it's important to choose a provider that offers excellent customer support. Look for a provider that provides timely and responsive assistance to address any payroll-related questions or concerns.

- Cost and Pricing: Consider the pricing structure of the payroll provider and evaluate whether it aligns with your budget. Compare the costs of different providers and assess the value they offer in terms of services provided and customer support.

Key Features to Look for in a Payroll Provider

When evaluating payroll providers for your recording studio, look for the following key features:

- Automated Payroll Processing: The payroll provider should offer automated systems that can handle all aspects of payroll processing, including calculating salaries, deducting taxes, and generating pay stubs. This reduces the chances of errors and saves you time.

- Tax Compliance: Ensure that the payroll provider has expertise in tax regulations and can handle tax filings accurately and on time. They should stay up-to-date with changes in tax laws and protect you from potential penalties or legal issues.

- Employee Self-Service: Look for a provider that offers an employee self-service portal. This allows your employees to access their pay stubs, tax forms, and other payroll-related information online, reducing administrative work for you.

- Reporting and Analytics: The payroll provider should offer robust reporting capabilities that allow you to generate various payroll reports, such as payroll summaries, tax reports, and employee earnings statements. These reports provide valuable insights into your payroll data and help you make informed decisions.

- Integration with Studio Management Systems: Consider whether the payroll provider's software can integrate seamlessly with your existing studio management systems, such as project management software or time tracking tools. This ensures smooth data transfer and eliminates the need for manual data entry.

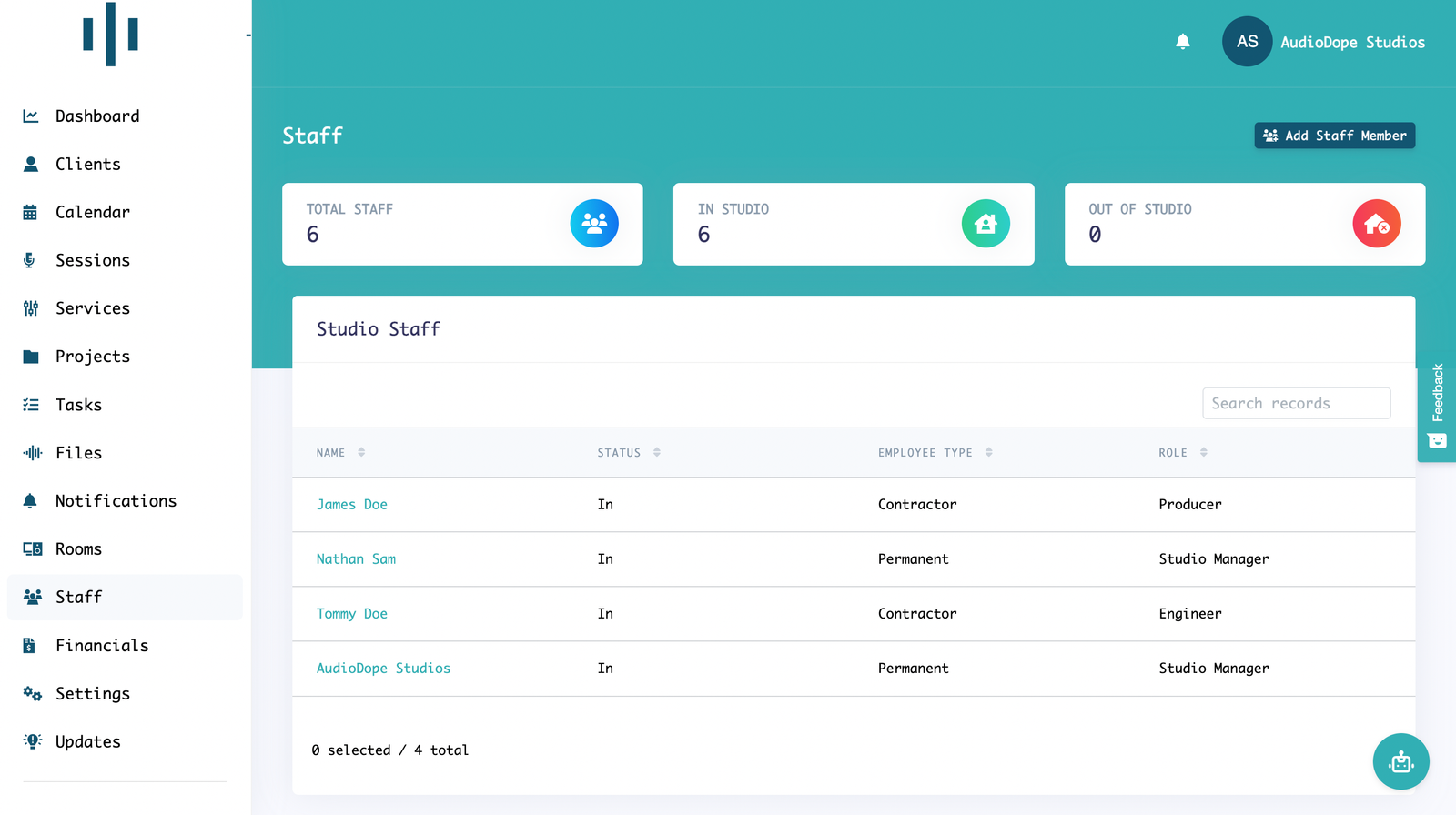

Setting Up Payroll with a Provider in the Recording Studio

Setting up payroll with a payroll provider is a straightforward process. Here are the general steps involved:

- Evaluate Your Payroll Needs: Determine your payroll requirements, such as the number of employees, payment structures, and tax obligations. This will help you communicate your needs effectively to the payroll provider.

- Research and Shortlist Providers: Research different payroll providers and compare their features, pricing, and customer reviews. Shortlist a few providers that align with your requirements and budget.

- Schedule Consultations: Contact the shortlisted providers and schedule consultations to discuss your payroll needs and evaluate their services. Ask questions about their experience, technology, and customer support.

- Gather Required Information: Prepare the necessary information and documents for payroll setup, such as employee details, tax identification numbers, and bank account information. The payroll provider will guide you on the specific requirements.

- Provide Information to the Provider: Share the required information with the payroll provider, either through their online platform or by providing physical copies. Ensure that all information is accurate and complete.

- Review and Approve Payroll: Once the payroll provider has set up your payroll system, review and approve the first payroll run. Check the accuracy of employee information, tax calculations, and payment amounts.

- Employee Onboarding: Inform your employees about the transition to the new payroll system and provide them with login details for the employee self-service portal. Train them on how to access their pay stubs and other payroll-related information.

- Monitor and Review: Regularly monitor your payroll processes and review the accuracy of payments and tax filings. Address any issues or discrepancies promptly with the payroll provider.

Ensuring Compliance with Payroll Regulations in the Recording Studio

Compliance with payroll regulations is essential for recording studios to avoid legal issues and penalties. Here are some tips to ensure compliance:

- Stay Informed: Stay updated on the latest tax regulations and employment laws that apply to your recording studio. Regularly check government websites or consult with a payroll provider to ensure you are aware of any changes.

- Maintain Accurate Records: Keep detailed records of employee hours, wages, tax deductions, and other payroll-related information. These records should be easily accessible and organized for future reference or audits.

- Timely Tax Filings: Ensure that you meet all tax filing deadlines and submit accurate tax returns to the relevant tax authorities. Late or incorrect tax filings can result in penalties and audits.

- Understand Classification Rules: Understand the rules governing the classification of employees and independent contractors. Misclassifying workers can lead to legal and financial consequences. Seek legal advice if you are unsure about the classification of certain workers.

- Work with a Payroll Provider: Partnering with a payroll provider can greatly assist with compliance. They have the expertise to handle tax calculations, deductions, and filings accurately. They also stay updated with any changes in tax regulations, ensuring compliance on your behalf.

Integrating Payroll with Other Studio Management Systems

Integrating your payroll system with other studio management systems can streamline your operations and improve efficiency. Here are some common integrations to consider:

- Project Management Software: Integrate your payroll system with project management software to track employee hours worked on different projects. This simplifies payroll calculations and ensures accurate project-based payments.

- Time Tracking Tools: Connect your time tracking tools with your payroll system to automatically import employee hours and eliminate manual data entry. This reduces the chances of errors and saves time.

- Accounting Software: Integrate your payroll system with your accounting software to seamlessly transfer payroll data for financial reporting and analysis. This eliminates the need for duplicate data entry and ensures accurate financial records.

- Human Resources Management System (HRMS): If you use an HRMS, integrate it with your payroll system to streamline employee onboarding, manage benefits, and automate HR processes. This enhances overall efficiency and reduces administrative work.

By integrating your payroll system with other studio management systems, you can eliminate manual data entry, reduce errors, and improve overall productivity.

Cost Considerations of Using a Payroll Provider

The cost of using a payroll provider in the recording studio industry varies depending on several factors, such as the number of employees, the complexity of payroll processes, and the specific services required. Here are some cost considerations:

- Subscription or Per-Payroll Fees: Payroll providers may charge a monthly or annual subscription fee for access to their software and services. Alternatively, they may charge a fee per payroll run. Consider your budget and frequency of payroll to determine the most cost-effective option.

- Additional Service Fees: Some payroll providers may charge additional fees for services such as tax filing, generating year-end tax forms, or providing custom reports. Discuss these fees with the providers and evaluate whether they align with your requirements and budget.

- Scalability: Consider the scalability of the payroll provider's pricing structure. If you anticipate significant growth in your recording studio, choose a provider that offers flexible pricing options that can accommodate your expanding workforce.

- Value of Services: Assess the value that the payroll provider offers in terms of their expertise, customer support, and features of their software. Sometimes, paying a slightly higher fee for a provider that offers comprehensive services and excellent support can be more cost-effective in the long run.

When comparing costs, remember to consider the time and effort saved by using a payroll provider. Outsourcing payroll allows you to focus on revenue-generating activities, which can ultimately offset the cost of the service.

Conclusion: Streamlining Your Payroll Processes with a Payroll Provider in the Recording Studio

Managing payroll in a recording studio can be complex and time-consuming, especially as your creative team grows. Using a payroll provider offers numerous benefits, including time and cost savings, improved accuracy and compliance, enhanced employee satisfaction, and streamlined processes.

When choosing a payroll provider, consider their experience, scalability, technology integration, support, and pricing. Ensure that the provider offers key features such as automated payroll processing, tax compliance, employee self-service, reporting and analytics, and integration with your studio management systems.

By using a payroll provider, you can bring harmony to your recording studio operations and focus on what you do best - producing great music. So, take the leap and let a payroll provider handle your payroll needs, while you create the sounds that move the world.