Mastering the Books: A Comprehensive Guide to Accounting for Recording Studios

In our last article, we touched on The Future of Invoicing in the Recording Studio. However, managing the accounting side of your business can often be overwhelming and time-consuming.

That's where this guide comes in. Whether you're just starting out or looking to improve your existing accounting practices, we've got you covered.

Throughout this guide, we will explore the key aspects of accounting for recording studios, including setting up a chart of accounts, managing income and expenses, understanding tax obligations, and tracking client invoices and payments.

By mastering these principles, you will gain valuable insights into your studio's financial health and make informed business decisions.

Join us as we demystify the world of accounting and equip you with the tools you need to take control of your studio's finances. Let's dive in and make your books sing!

Importance of Accounting in the Recording Studio Industry

Accounting is a crucial aspect of running a successful recording studio. It goes beyond simply tracking your income and expenses; it provides you with a clear understanding of your studio's financial performance and helps you make informed decisions for growth.

One of the key benefits of accounting is the ability to monitor your studio's profitability. By keeping track of your revenue streams and expenses, you can identify which areas of your business are generating the most income and which ones may need improvement. This knowledge allows you to allocate resources effectively and maximize your studio's potential.

Additionally, accounting provides you with the necessary information to meet your tax obligations. By keeping accurate records of your income and expenses, you can ensure that you are properly reporting your earnings and taking advantage of any tax deductions available to you as a recording studio owner. Failing to comply with tax regulations can result in penalties and potential legal issues, so it's essential to have solid accounting practices in place.

Furthermore, having a clear picture of your studio's financial health enables you to make strategic business decisions. Whether you're considering investing in new equipment or expanding your services, having accurate financial information allows you to assess the feasibility and potential impact of these decisions. Ultimately, accounting empowers you to take control of your studio's finances and pave the way for long-term success.

Key Financial Concepts for Recording Studios

Before diving into the nitty-gritty of accounting for recording studios, it's important to understand some key financial concepts that are relevant to your business. These concepts will serve as the foundation for effective financial management and decision-making.

- Revenue Streams: As a recording studio, your primary source of revenue is likely to come from recording sessions. However, it's important to consider other potential revenue streams, such as equipment rentals, audio engineering services, and music production. Diversifying your revenue streams can help stabilize your income and increase profitability.

- Expense Categories: Recording studios have unique expense categories that are specific to the industry. Some common expense categories include rent or mortgage payments for your studio space, equipment purchases and maintenance, utilities, marketing and advertising costs, employee wages, and royalties or licensing fees. Categorizing your expenses correctly enables you to track and analyze your spending patterns more effectively.

- Profit Margin: Understanding your studio's profit margin is essential for assessing your financial performance. Profit margin is calculated by subtracting your total expenses from your total revenue and dividing the result by your total revenue. A higher profit margin indicates better financial health and efficiency.

By familiarizing yourself with these financial concepts, you will have a solid foundation for implementing effective accounting practices tailored to the recording studio industry.

Setting up an Accounting System for a Recording Studio

To effectively manage your studio's finances, it's crucial to set up a robust accounting system. This system will serve as the backbone of your financial operations and provide you with accurate and up-to-date information about your studio's financial health. Here are the key steps to setting up an accounting system for your recording studio:

- Choose an Accounting Method: There are two primary accounting methods: cash basis and accrual basis. Cash basis accounting records transactions when cash is received or paid, while accrual basis accounting records transactions when they occur, regardless of the timing of cash flow. Choose the method that aligns best with your studio's needs and consult with an accountant if necessary.

- Create a Chart of Accounts: A chart of accounts is a list of all the accounts you will use to track your studio's financial transactions. It includes categories such as assets, liabilities, equity, revenue, and expenses. Customize your chart of accounts to reflect the unique aspects of your recording studio and ensure that it captures all the necessary financial information.

- Implement a Bookkeeping System: Bookkeeping is the process of recording your financial transactions, including income and expenses. There are various bookkeeping methods you can choose from, such as manual bookkeeping using spreadsheets or utilizing accounting software. Select the method that suits your studio's size and complexity, and establish a consistent bookkeeping routine to maintain accurate records.

- Establish Internal Controls: Internal controls are procedures and policies that safeguard your studio's assets and prevent fraud or errors. Implementing internal controls will ensure that your financial data is accurate and reliable. Some examples of internal controls include segregating duties, regularly reconciling bank statements, and conducting periodic audits.

By following these steps, you will lay the foundation for an effective accounting system that will streamline your financial processes and provide you with the data you need to make informed decisions.

Recording Studio Revenue Streams and Expense Categories

Managing your studio's income and expenses is a critical part of accounting. By properly categorizing and tracking your revenue streams and expenses, you can gain valuable insights into your studio's financial performance and identify areas for improvement. Here are some common revenue streams and expense categories for recording studios:

Revenue Streams

- Recording Sessions: Recording sessions are likely to be your primary source of revenue. This includes fees charged for studio time, equipment usage, and engineering services. It's important to track the revenue generated from each recording session separately to understand their individual profitability.

- Equipment Rentals: If you have high-quality equipment that is in demand, renting it out to other musicians or recording studios can be a lucrative revenue stream. Keep track of the rental income and any associated expenses, such as maintenance or repairs.

- Audio Engineering Services: If you have skilled audio engineers on your team, offering their services for mixing, mastering, or sound design can be an additional revenue stream. Make sure to track the income generated from these services separately.

- Music Production: If you offer music production services, such as creating beats or producing tracks, track the revenue earned from these services. This can be a significant source of income, especially if you work with independent artists.

Expense Categories

- Rent or Mortgage: Your studio's rent or mortgage payments are a significant expense category. Ensure that you accurately record these payments and allocate them to the appropriate account.

- Equipment Purchases and Maintenance: Recording equipment is essential to your business, and both purchases and maintenance costs should be tracked separately. This will help you assess the lifespan of your equipment and plan for future upgrades or replacements.

- Utilities: Electricity, water, internet, and other utilities are essential for running your studio. Monitor and categorize these expenses to understand your operational costs.

- Marketing and Advertising: Promoting your studio is crucial for attracting clients. Track your marketing and advertising expenses, including online ads, print materials, and website maintenance.

- Employee Wages: If you have employees, their wages should be recorded as an expense. This includes audio engineers, receptionists, or any other staff members.

- Royalties and Licensing Fees: If you license music or use copyrighted material in your recordings, track any royalties or licensing fees paid to ensure compliance and accurate financial reporting.

By categorizing your revenue streams and expenses accurately, you will have a clear understanding of your studio's financial performance and be able to identify areas for improvement or cost-saving opportunities.

Managing Cash Flow and Budgeting for a Recording Studio

Managing cash flow is crucial for the financial stability and success of your recording studio. Cash flow refers to the movement of money in and out of your business and is essential for covering expenses, investing in equipment, and ensuring a healthy financial position. Here are some tips for managing cash flow and budgeting effectively:

- Create a Cash Flow Forecast: A cash flow forecast helps you anticipate when money will be coming in and going out of your studio. By projecting your expected income and expenses over a specific period, you can identify potential cash flow gaps and plan accordingly. This will help you avoid any cash shortages and ensure that you have enough funds to cover your obligations.

- Monitor Accounts Receivable: Recording studios often rely on invoicing clients for their services, which means you may have outstanding invoices waiting to be paid. Regularly monitor your accounts receivable to ensure that clients are paying on time. Follow up on any overdue payments promptly to maintain a healthy cash flow.

- Negotiate Payment Terms: When working with clients, consider negotiating payment terms that are favorable for your cash flow. For example, you may request a deposit upfront or set specific milestones for payments throughout a project. This helps ensure a steady cash flow and reduces the risk of late or missed payments.

- Implement a Budget: A budget is a crucial tool for financial planning and control. It helps you allocate your resources effectively and ensures that you are not overspending in any particular area. Consider your projected revenue and expenses when creating a budget, and regularly review and adjust it as needed.

- Manage Expenses: Monitoring and controlling your expenses is essential for maintaining a healthy cash flow. Regularly review your expense categories and look for areas where you can reduce costs without compromising the quality of your services. This may involve negotiating better deals with suppliers or finding more cost-effective alternatives.

By implementing these strategies, you can ensure that your recording studio has a steady cash flow and remains financially stable. This will enable you to invest in equipment upgrades, hire top talent, and grow your business.

Tax Considerations for Recording Studios

Understanding your tax obligations as a recording studio owner is crucial for staying compliant and minimizing your tax burden. Here are some key tax considerations to keep in mind:

- Business Structure: The legal structure of your recording studio, such as sole proprietorship, partnership, or limited liability company (LLC), affects how your business is taxed. Consult with a tax professional to determine the most advantageous structure for your studio.

- Sales Tax: Depending on your location, you may be required to collect and remit sales tax on your studio's services. Familiarize yourself with the sales tax regulations in your jurisdiction and ensure that you are charging and reporting the appropriate amount.

- Income Tax: Recording studio owners are responsible for reporting their business income on their personal or corporate tax returns. Accurately track your revenue and deduct any eligible business expenses to determine your taxable income. Consult with a tax professional to ensure that you are maximizing your deductions and taking advantage of any available tax credits.

- Employment Taxes: If you have employees, you are responsible for withholding and remitting payroll taxes on their behalf. This includes Social Security and Medicare taxes, as well as federal and state income tax withholdings. Familiarize yourself with the tax requirements for employers and ensure that you are compliant.

- Record Keeping: Maintaining accurate and organized records is essential for tax compliance. Keep all relevant financial documents, such as invoices, receipts, and bank statements, and ensure that they are easily accessible if needed for tax purposes. Consider using accounting software to streamline your record-keeping process and generate accurate financial reports.

It's important to consult with a qualified tax professional to ensure that you are meeting all your tax obligations and taking advantage of any available tax benefits specific to the recording studio industry. By staying compliant, you can avoid penalties and legal issues while optimizing your tax position.

Financial Reporting and Analysis for Recording Studios

Financial reporting and analysis provide valuable insights into your recording studio's financial performance and help you make informed business decisions. Here are some key reports and analysis techniques to consider:

- Profit and Loss Statement: Also known as an income statement, this report summarizes your studio's revenue, expenses, and net profit or loss over a specific period. It provides a snapshot of your financial performance and helps you identify areas where you can improve profitability.

- Balance Sheet: A balance sheet provides a snapshot of your studio's financial position at a specific point in time. It includes your assets, liabilities, and equity. By analyzing your balance sheet, you can assess your studio's liquidity, solvency, and overall financial health.

- Cash Flow Statement: A cash flow statement tracks the movement of cash in and out of your studio over a specific period. It categorizes cash flows into operating activities, investing activities, and financing activities. Analyzing your cash flow statement helps you understand your studio's cash inflows and outflows and identify any potential cash flow issues.

- Financial Ratios: Financial ratios are used to analyze your studio's financial performance and compare it to industry benchmarks. Some common ratios for recording studios include gross profit margin, return on assets, and debt-to-equity ratio. These ratios provide insights into your studio's profitability, efficiency, and financial stability.

Regularly reviewing and analyzing these financial reports will enable you to identify trends, spot potential issues, and make data-driven decisions for your recording studio. If you're not familiar with financial analysis techniques, consider working with a professional accountant who can help you interpret the numbers and provide valuable insights.

Accounting Software for Recording Studios

Utilizing accounting software can streamline your financial processes, improve accuracy, and save you time and effort. Here are some popular accounting software options tailored for recording studios:

There are several accounting software options available that cater specifically to small businesses, including recording studios. Here are some of the top choices:

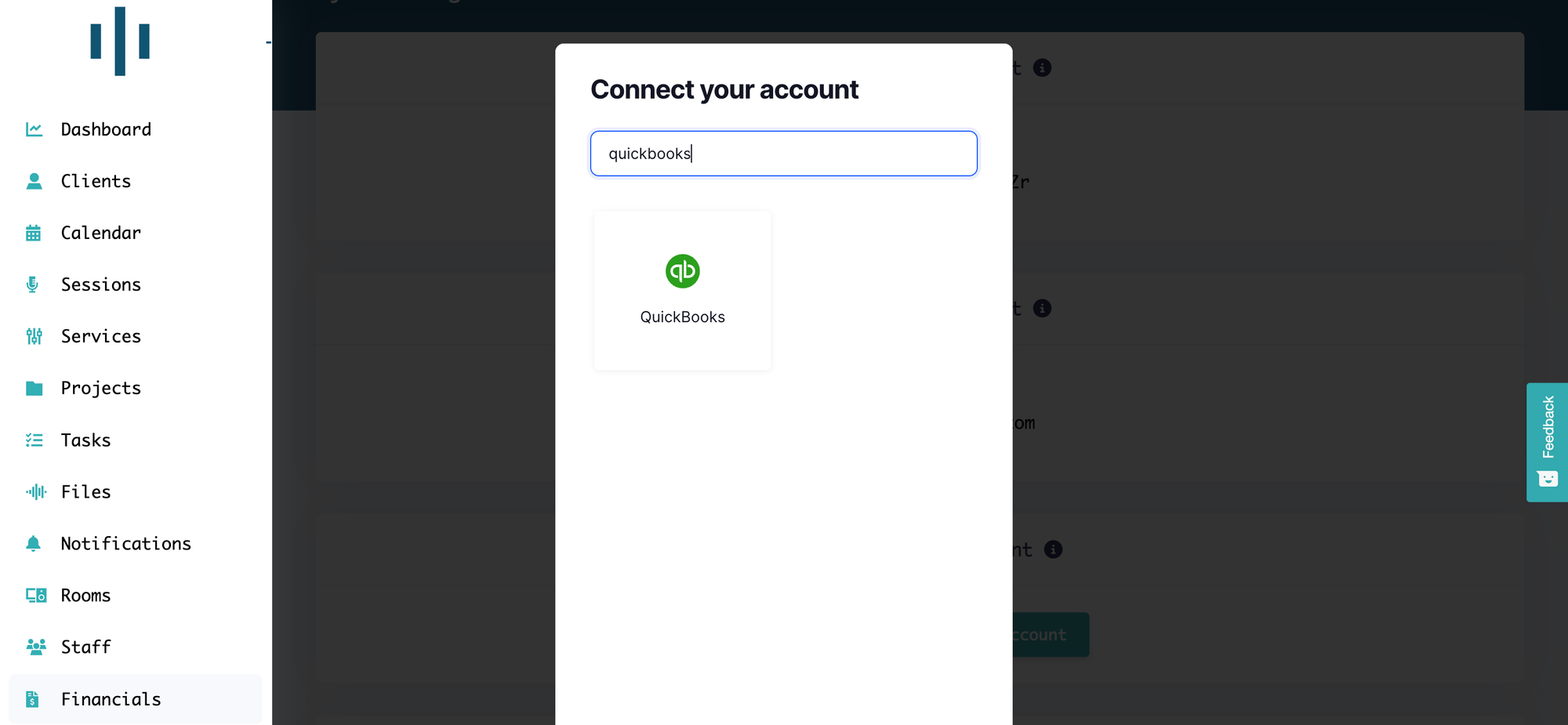

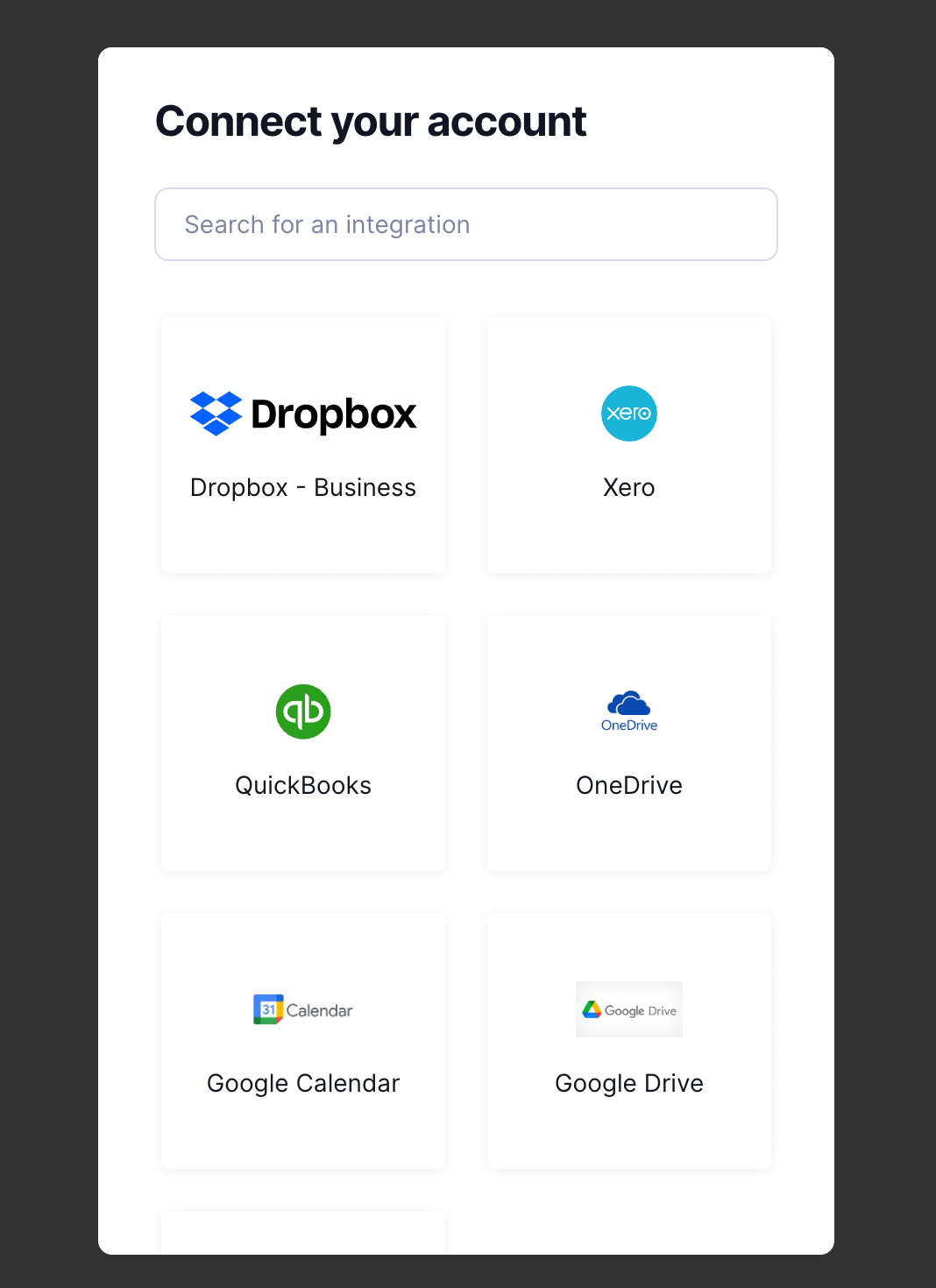

- QuickBooks: QuickBooks is a popular accounting software widely used by small businesses. It offers a range of features, including invoicing, expense tracking, and financial reporting. QuickBooks also integrates with various other business tools, such as point-of-sale systems and project management software.

- Xero: Xero is another cloud-based accounting software known for its user-friendly interface and extensive feature set. It offers invoicing, expense tracking, bank reconciliation, and financial reporting. Xero also integrates with a wide range of third-party apps, allowing you to customize and expand its functionality.

- Wave: Wave is a free accounting software that caters to small businesses and freelancers. While it may not have all the advanced features of paid software, it offers essential functionality, including invoicing, expense tracking, and financial reporting. Wave also integrates with payment processors, making it easy to accept online payments.

Conclusion: The impact of an accounting system on studio profitability

In conclusion, implementing an accounting system specifically designed for recording studios is crucial for the long-term success and profitability of your business. It provides you with the tools and insights necessary to keep your studio's finances in harmony with its operations.

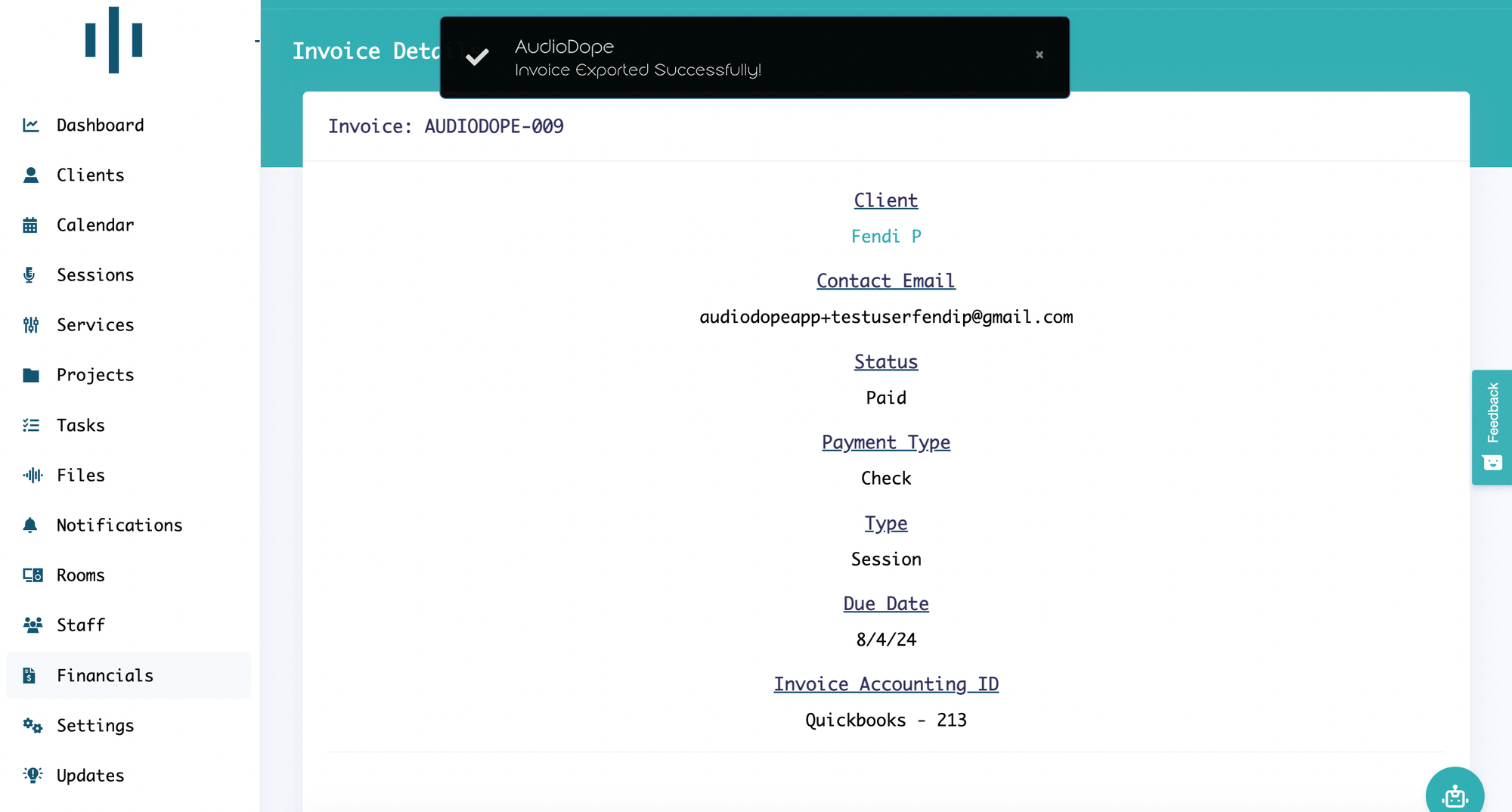

By selecting the right accounting software and integrating it into your studio's processes, you can ensure accurate financial records, comply with legal requirements, and gain real-time visibility into your studio's financial health.

Combine this with studio management software like AudioDope Studio Manager, and you have a comprehensive solution that streamlines your operations and maximizes profitability.