Tax Season: Step-by-Step Guide to Mastering Taxes for Your Recording Studio

As the owner of a recording studio, navigating the intricate world of taxes can be a daunting task. However, understanding and properly handling your tax obligations is crucial for the success and longevity of your studio business.

In this comprehensive guide, we aim to demystify the process of mastering taxes for your recording studio, ensuring you remain compliant while maximizing your financial efficiency.

Taxes are an integral part of running any business, and recording studios are no exception. Failing to comply with tax regulations can lead to severe consequences, including hefty fines, penalties, and even legal repercussions.

By taking a proactive approach and familiarizing yourself with the tax landscape, you can avoid potential pitfalls and focus on what truly matters – creating exceptional audio. Before diving in make sure you are familiar with studio accounting concepts that you refer to in our previous blog

Understanding different types of taxes for recording studios

As a recording studio owner, you will encounter various types of taxes, each with its own set of rules and regulations. Familiarizing yourself with these taxes is the first step towards effective tax management.

- Income Tax: This tax is levied on the net profit generated by your recording studio. It is crucial to accurately calculate your taxable income, which includes revenue from services rendered, equipment rentals, and any other income sources related to your business operations.

- Self-Employment Tax: If you operate your recording studio as a sole proprietorship or partnership, you will be subject to self-employment tax. This tax covers your contributions to Social Security and Medicare, and it is calculated based on your net earnings from self-employment.

- Sales Tax: Depending on your state and local laws, you may be required to collect and remit sales tax on certain services or products offered by your recording studio. It is essential to understand the specific sales tax regulations in your area and comply with them accordingly.

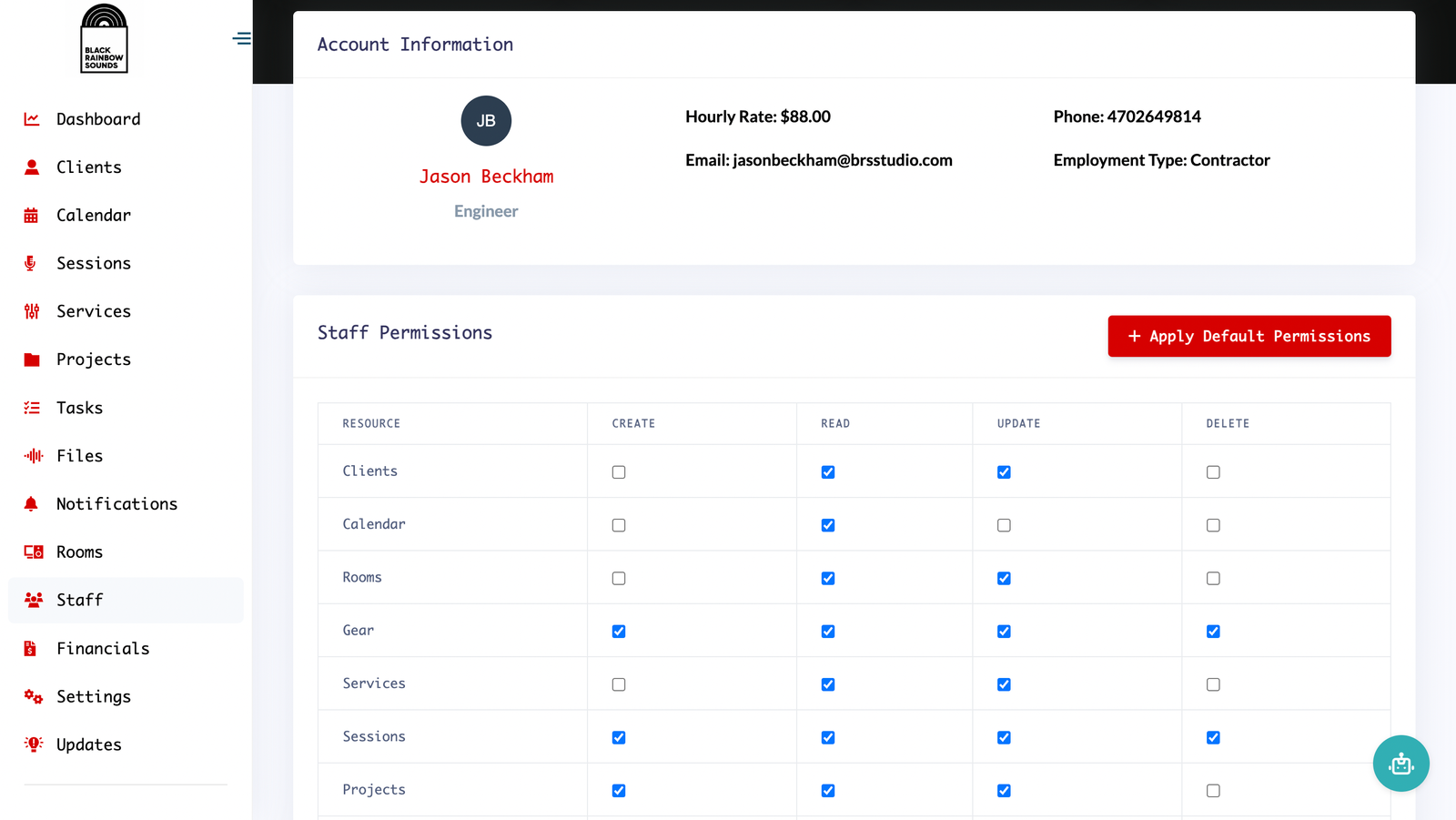

- Payroll Taxes: If you have employees working at your recording studio, you will be responsible for withholding and remitting payroll taxes, such as federal income tax, Social Security tax, and Medicare tax. Failure to comply with payroll tax regulations can result in significant penalties.

- Property Tax: If you own the physical premises where your recording studio operates, you will likely be subject to property taxes. These taxes are typically assessed by local governments and are based on the value of your property.

Understanding the different types of taxes applicable to your recording studio is the first step towards effective tax management. By being aware of your tax obligations, you can plan accordingly and ensure compliance with all relevant regulations.

Tax deductions and credits for recording studios

While taxes can be a significant expense for your recording studio, there are various deductions and credits available that can help reduce your tax liability. Leveraging these deductions and credits can significantly impact your bottom line and provide much-needed financial relief.

- Business Expenses: One of the most significant deductions available to recording studio owners is the deduction for ordinary and necessary business expenses. These expenses can include rent or mortgage payments for your studio space, utilities, equipment purchases or rentals, advertising and marketing costs, and employee salaries and benefits.

- Depreciation: Recording studios often invest in expensive equipment, such as mixing consoles, microphones, and studio monitors. These assets can be depreciated over their useful life, allowing you to deduct a portion of their cost each year as a business expense.

- Home Office Deduction: If you operate your recording studio from a dedicated workspace within your home, you may be eligible for the home office deduction. This deduction allows you to deduct a portion of your household expenses, such as rent, utilities, and maintenance costs, based on the percentage of your home used for business purposes.

- Research and Development (R&D) Tax Credit: If your recording studio engages in research and development activities, such as developing new audio processing techniques or software, you may qualify for the R&D tax credit. This credit can significantly reduce your tax liability and encourage innovation within your business.

- Energy-Efficient Upgrades: If you have made energy-efficient upgrades to your recording studio, such as installing solar panels or energy-efficient lighting, you may be eligible for various tax credits and deductions. These incentives aim to promote sustainable business practices and reduce energy consumption.

To take advantage of these deductions and credits, it is essential to maintain accurate records and consult with a tax professional. They can guide you through the process and ensure you maximize your tax savings while remaining compliant with all applicable regulations.

Recordkeeping for tax purposes

Proper recordkeeping is a critical aspect of effective tax management for your recording studio. Maintaining accurate and organized records not only simplifies the tax filing process but also ensures compliance with tax laws and regulations.

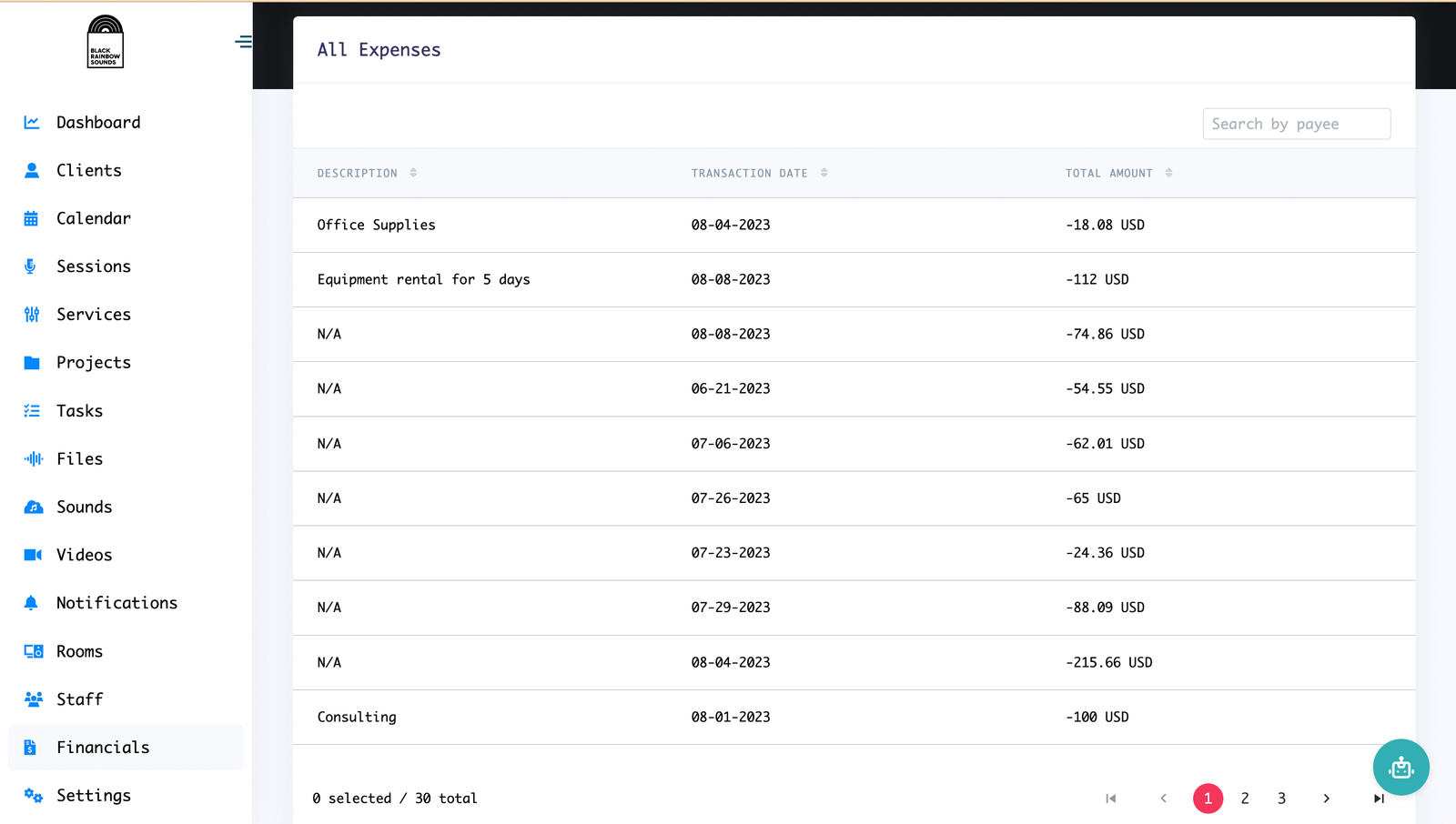

- Income and Expense Records: Keep detailed records of all income sources, including client invoices, equipment rental fees, and any other revenue streams. Similarly, maintain meticulous records of all business expenses, such as equipment purchases, studio rent, utilities, and employee salaries.

- Receipts and Invoices: Retain all receipts and invoices related to your business expenses. These documents serve as proof of your expenditures and can be invaluable in the event of an audit or tax dispute.

- Mileage Logs: If you use a personal vehicle for business purposes, such as transporting equipment or visiting clients, maintain a mileage log to track your business-related travel. This information can be used to claim deductions for vehicle expenses.

- Asset Records: Keep detailed records of all business assets, including equipment purchases, depreciation schedules, and any disposals or trade-ins. These records are essential for calculating depreciation deductions and determining potential gains or losses on asset disposals.

- Employee Records: If you have employees, maintain accurate payroll records, including employee information, hours worked, wages paid, and tax withholdings. These records are crucial for complying with payroll tax regulations and ensuring accurate reporting.

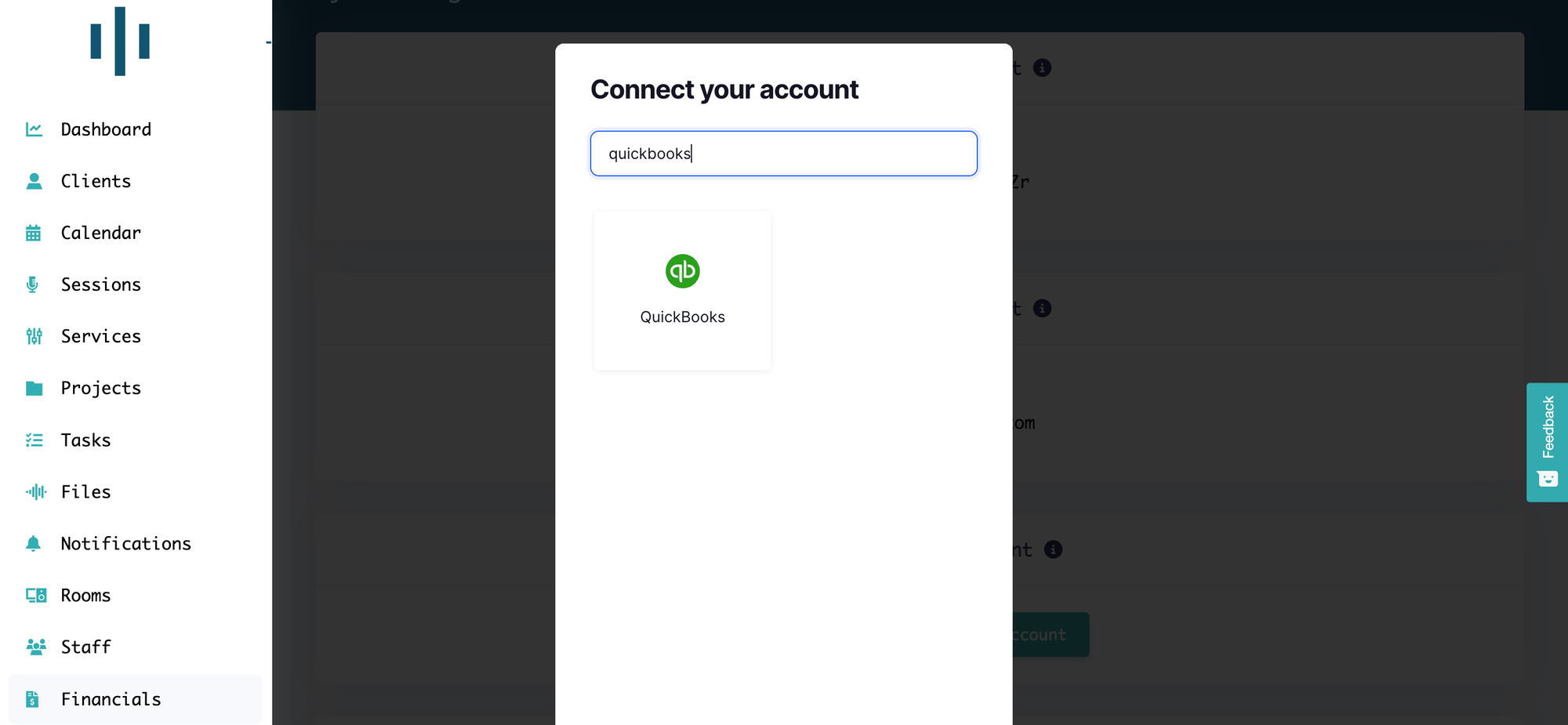

Consider investing in accounting software or hiring a bookkeeper to streamline your recordkeeping process. Maintaining organized and accurate records not only simplifies tax preparation but also provides a solid foundation for defending your tax positions in the event of an audit or inquiry.

Hiring a tax professional for your recording studio

While it is possible to handle your recording studio's taxes on your own, engaging the services of a qualified tax professional can provide numerous benefits and ensure compliance with complex tax laws and regulations.

- Expertise and Knowledge: Tax professionals, such as certified public accountants (CPAs) or enrolled agents, possess extensive knowledge of tax laws and regulations specific to the recording industry. They can provide valuable guidance and insights to help you maximize deductions, credits, and minimize your overall tax liability.

- Time-Saving: Preparing and filing taxes can be a time-consuming and complex process, especially for recording studio owners who are already juggling numerous responsibilities. By hiring a tax professional, you can free up valuable time to focus on running your business and pursuing your creative endeavors.

- Audit Representation: In the event of a tax audit or inquiry, a tax professional can represent you and advocate on your behalf. Their expertise and experience in dealing with tax authorities can be invaluable in resolving any issues or disputes that may arise.

- Tax Planning: Tax professionals can provide proactive tax planning services, helping you structure your business operations and financial transactions in a tax-efficient manner. This can involve strategies such as incorporating, setting up retirement plans, or exploring various tax incentives and credits.

- Peace of Mind: Entrusting your tax matters to a qualified professional can provide peace of mind, knowing that your tax obligations are being handled accurately and in compliance with all applicable laws and regulations.

When selecting a tax professional, consider their qualifications, experience in the recording industry, and reputation.

Additionally, ensure that you feel comfortable communicating with them and that they understand the unique needs and challenges of your recording studio business.

Tips for minimizing tax liability for recording studios

While taxes are an inevitable part of running a recording studio, there are several strategies you can implement to legally minimize your tax liability and maximize your financial efficiency.

- Maximize Deductions: Carefully review all eligible business expenses and ensure you are claiming all deductions to which you are entitled. This can include expenses related to equipment purchases, studio rent, utilities, marketing, and employee salaries and benefits.

- Utilize Tax Credits: Explore various tax credits available to recording studios, such as the Research and Development (R&D) tax credit, energy-efficient upgrades, and any industry-specific incentives. These credits can directly reduce your tax liability, providing significant savings.

- Timing of Income and Expenses: Strategically timing the recognition of income and expenses can have a significant impact on your tax liability. For example, deferring income to the next tax year or accelerating deductible expenses can potentially reduce your taxable income in the current year.

- Retirement Planning: Establishing a retirement plan, such as a 401(k) or a Simplified Employee Pension (SEP) plan, can provide tax advantages while helping you and your employees save for retirement. Contributions to these plans can be tax-deductible, reducing your taxable income.

- Incorporate Your Business: Depending on your specific circumstances, incorporating your recording studio as a limited liability company (LLC) or a corporation can offer tax benefits and potential liability protection. Consult with a tax professional to determine the most suitable business structure for your studio.

- Invest in Tax-Advantaged Assets: Explore investment opportunities that offer tax advantages, such as purchasing equipment or real estate that qualifies for accelerated depreciation or other tax incentives.

- Stay Updated on Tax Laws: Tax laws and regulations are constantly evolving. Stay informed about changes that may impact your recording studio by subscribing to industry publications, attending seminars, or consulting with your tax professional regularly.

Remember, minimizing your tax liability should always be done within the confines of the law. Engaging in illegal tax avoidance schemes can result in severe penalties and potential legal consequences.

Common tax mistakes to avoid for recording studios

While navigating the tax landscape for your recording studio, it is essential to be aware of common mistakes that can lead to costly penalties, interest charges, or even legal troubles. By understanding and avoiding these pitfalls, you can ensure compliance and protect your business's financial well-being.

- Misclassifying Employees: Incorrectly classifying employees as independent contractors can result in significant penalties and back taxes. It is crucial to understand the distinction between employees and contractors and classify your workers accordingly.

- Failing to Maintain Accurate Records: Inadequate recordkeeping can lead to missed deductions, incorrect tax calculations, and potential audits. Maintain detailed records of all income, expenses, assets, and employee information to ensure compliance and maximize tax savings.

- Overlooking Estimated Tax Payments: If you operate your recording studio as a sole proprietorship or partnership, you may be required to make estimated tax payments throughout the year. Failing to do so can result in penalties and interest charges.

- Mixing Personal and Business Expenses: Commingling personal and business expenses can lead to disallowed deductions and potential audits. Keep separate records and accounts for your personal and business finances to avoid confusion and maintain compliance.

- Ignoring Sales Tax Obligations: Depending on your state and local laws, you may be required to collect and remit sales tax on certain services or products offered by your recording studio. Failure to comply with sales tax regulations can result in penalties and interest charges.

- Claiming Excessive or Unsupported Deductions: While deductions can significantly reduce your tax liability, it is essential to ensure that all claimed deductions are legitimate and supported by proper documentation. Claiming excessive or unsupported deductions can raise red flags and potentially lead to audits or penalties.

- Neglecting to File Tax Returns: Failing to file tax returns on time can result in substantial penalties and interest charges. Even if you cannot pay the full amount owed, it is crucial to file your returns on time to avoid additional penalties.

By being aware of these common tax mistakes and taking proactive measures to avoid them, you can protect your recording studio from unnecessary financial burdens and potential legal consequences.

The importance of staying updated with tax laws for recording studios

The tax landscape is constantly evolving, with new laws, regulations, and interpretations being introduced regularly. As a recording studio owner, staying informed about these changes is crucial for maintaining compliance and maximizing your financial efficiency.

- Legislative Changes: Tax laws are subject to frequent revisions and amendments by legislative bodies at the federal, state, and local levels. These changes can impact various aspects of your recording studio's tax obligations, including deductions, credits, filing requirements, and tax rates.

- Regulatory Updates: Government agencies, such as the Internal Revenue Service (IRS) and state tax authorities, regularly issue new regulations, guidance, and interpretations related to tax laws. Staying informed about these updates can help you avoid potential penalties and ensure compliance with the latest requirements.

- Industry-Specific Developments: The recording industry may be subject to unique tax rules and regulations specific to its operations. Staying abreast of industry-specific tax developments can help you identify potential opportunities or risks related to your recording studio's tax situation.

- Court Rulings: Tax-related court cases can set precedents and influence the interpretation and application of tax laws. Monitoring significant court rulings can provide insights into how tax authorities may view certain transactions or situations relevant to your recording studio.

- Technology Advancements: As technology continues to evolve, it can impact various aspects of your recording studio's operations, including recordkeeping, invoicing, and financial reporting. Staying informed about technology advancements can help you streamline your tax compliance processes and leverage new tools and resources.

To stay updated with tax laws and developments, consider subscribing to industry publications, attending seminars or webinars hosted by tax professionals or industry associations, and regularly consulting with your tax advisor.

Additionally, consider joining professional organizations or networking groups that provide access to valuable tax resources and insights specific to the recording industry.

Staying informed and proactive about tax law changes can help you avoid costly penalties, identify potential tax-saving opportunities, and ensure your recording studio remains compliant with all applicable regulations.

Resources for further tax guidance for recording studios

While this guide provides a comprehensive overview of tax management for recording studios, there are numerous additional resources available to help you navigate the complexities of tax laws and regulations.

- Internal Revenue Service (IRS): The IRS website (www.irs.gov) is a valuable resource for tax information, forms, publications, and guidance specific to small businesses and self-employed individuals. The IRS also offers educational materials, webinars, and online tools to assist taxpayers.

- State and Local Tax Authorities: Each state and local jurisdiction has its own tax laws and regulations. Consult with your state and local tax authorities for information on sales tax, income tax, property tax, and other relevant tax obligations specific to your recording studio's location.

- Industry Associations: Organizations such as the Recording Academy, the Music Business Association, and the American Federation of Musicians often provide tax resources and guidance tailored to the recording industry. Joining these associations can give you access to valuable tax insights and networking opportunities.

- Tax Professionals: Consulting with a qualified tax professional, such as a certified public accountant (CPA) or an enrolled agent, can provide personalized guidance and expertise specific to your recording studio's unique circumstances. They can assist with tax planning, preparation, and representation in the event of an audit or dispute.

- Tax Software and Online Resources: Various tax software programs and online resources are available to assist with tax preparation, recordkeeping, and compliance. These tools can streamline the tax process and provide access to up-to-date tax information and calculators.

- Continuing Education: Attending seminars, workshops, or online courses focused on tax topics can help you stay informed about the latest tax laws, regulations, and best practices relevant to the recording industry.

- Professional Networks: Networking with other recording studio owners, industry professionals, and tax experts can provide valuable insights, best practices, and potential solutions to common tax challenges faced by those in the recording industry.

By leveraging these resources and staying proactive in your tax education and compliance efforts, you can ensure that your recording studio remains financially efficient and compliant with all applicable tax laws and regulations.

Conclusion

Remember, taxes are an integral part of operating a recording studio, and compliance with tax laws and regulations is not only a legal requirement but also a responsible business practice.

By staying informed, proactive, and diligent in your tax management efforts, you can minimize your tax liability, avoid costly penalties, and focus on what truly matters – creating exceptional audio and growing your recording studio.